Individual Tax Rates 2025 Sars. Here are the latest income tax rates for individual south. 2025 tax rates, thresholds and allowance for individuals, companies, trusts and small business corporations (sbc) in south africa

Then follow the link to fin 24’s budget calculator (just follow the. Calculate your personal income tax for 2025/2025.

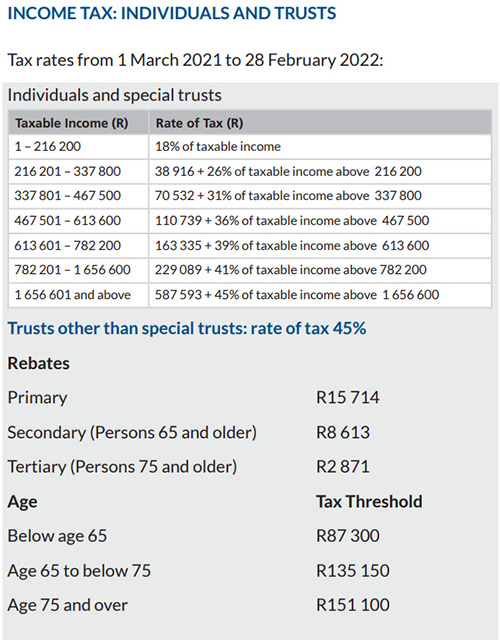

Tax rates for the 2025 year of assessment Just One Lap, Tax rates for individuals 2025 tax year. The rates of tax chargeable on taxable income are determined annually by parliament, and are generally referred to as “marginal rates of tax” or “statutory rates”.

Tax Brackets 2025 Sars Babs Marian, Individual income determines the tax rates. February 22, 2025 nyasha musviba.

2025 SARS Tax Rates Potential Increase and Updated Rates, Tax rates for individuals 2025 tax year. On this page you will see individuals tax table, as well as the tax rebates and tax.

SARS Tax Rates 2025 What are the SARS Tax Rates, Will There Be An, The top marginal income tax rate. 2025, 2025, 2025, 2025, 2025,.

SARS Tax Rates 2025 Exploring Taxation in South Africa, Rates of tax for individuals. Use our employee's tax calculator to work out how much paye and uif tax you will pay sars this year, along with your taxable income and tax rates.

Tax Brackets 2025 Sars Katey Scarlet, Dividends received by individuals from south african companies are generally exempt from income tax, but dividends tax at a rate of 20% is. Rates of tax for individuals.

Individual Tax Rates 2025 Ato Calla Corenda, The top marginal income tax rate. In this section you will find a list of income tax rates for the past few years for:

Budget 2025 Your Tax Tables and Tax Calculator SJ&A Chartered, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. This selection of official sars tax tables and other useful resources will help clarify your tax position for the new tax year.

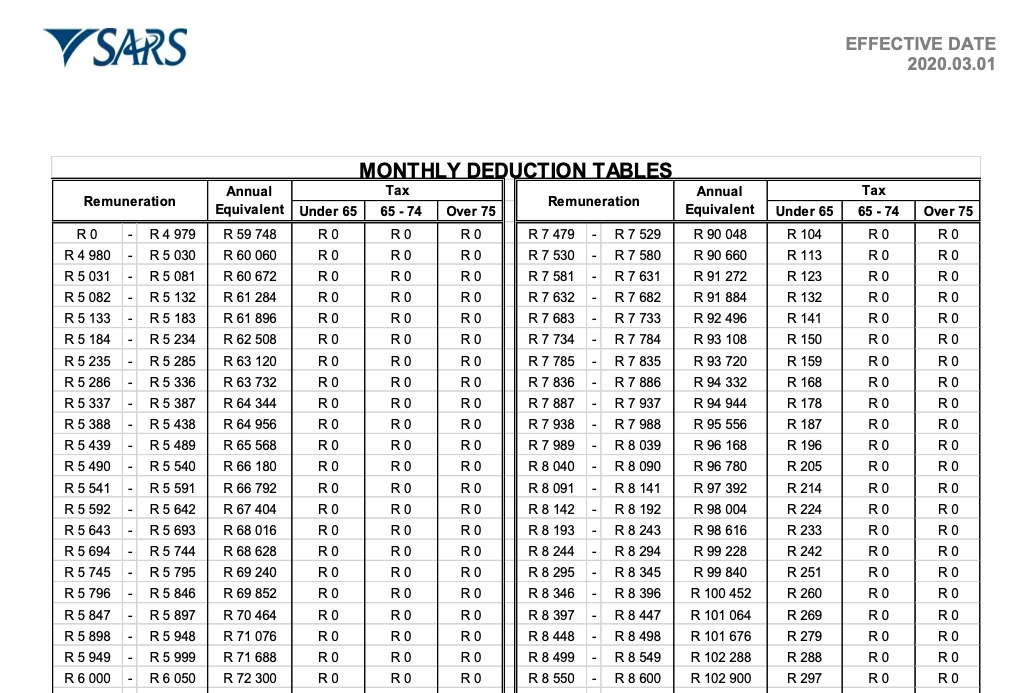

2025 Tax Code Changes Everything You Need To Know, Income tax tables with rebates and car allowance fix cost tables for the 2025 tax year as provided by sars. Access current & archived south african tax rates.

Sars Personal Tax Tables 2025 Whichpermit Free Download Nude, The rates of tax chargeable on taxable income are determined annually by parliament, and are generally referred to as “marginal rates of tax” or “statutory rates”. Dividends received by individuals from south african companies are generally exempt from income tax, but dividends tax at a rate of 20% is.

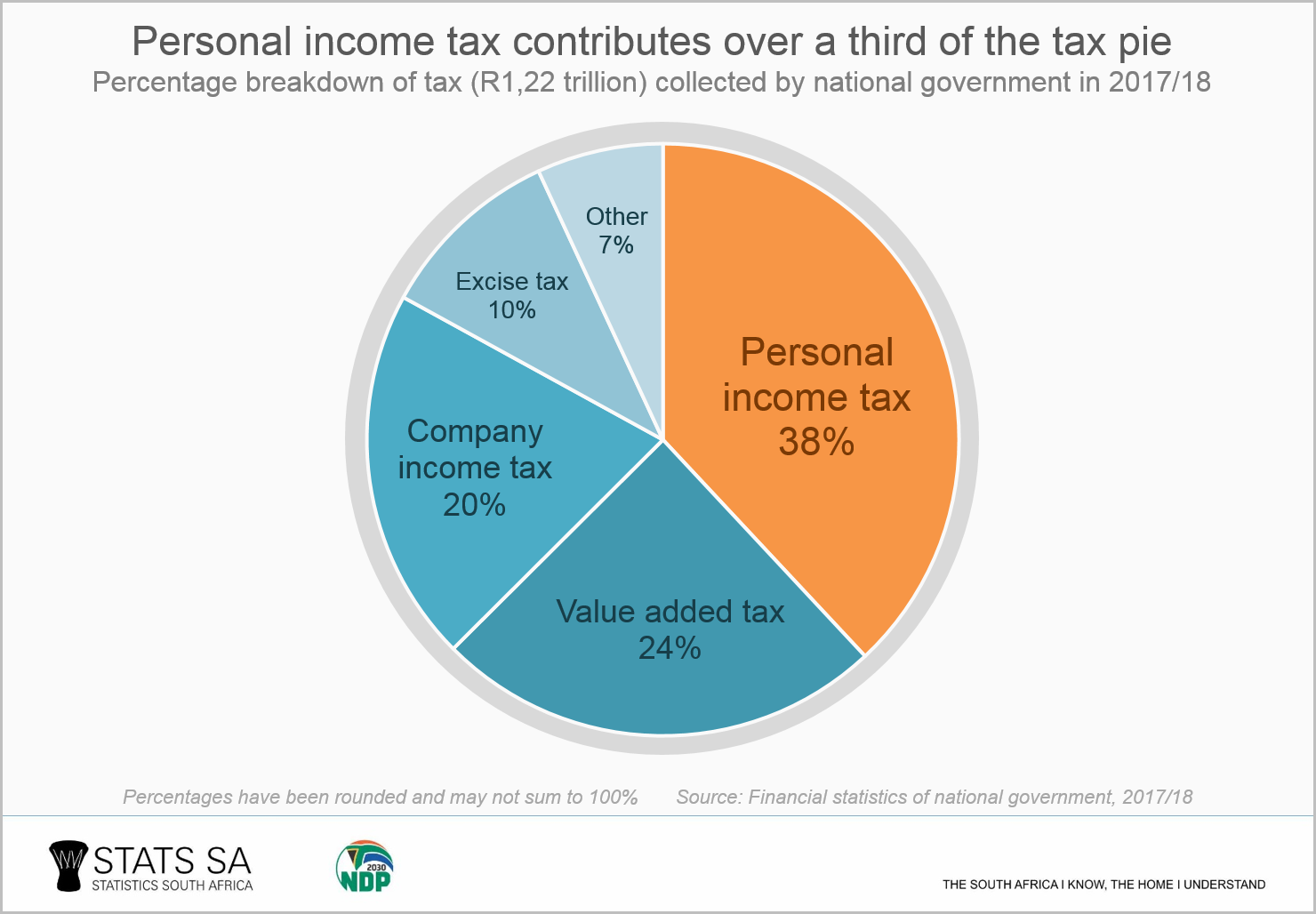

Budget 2025 effectively brought an increase in personal income tax by not adjusting the tables for tax rates, rebates and medical tax credits, while also implementing substantial increases in.