Fsa Annual Limit 2025 Calculator. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll.

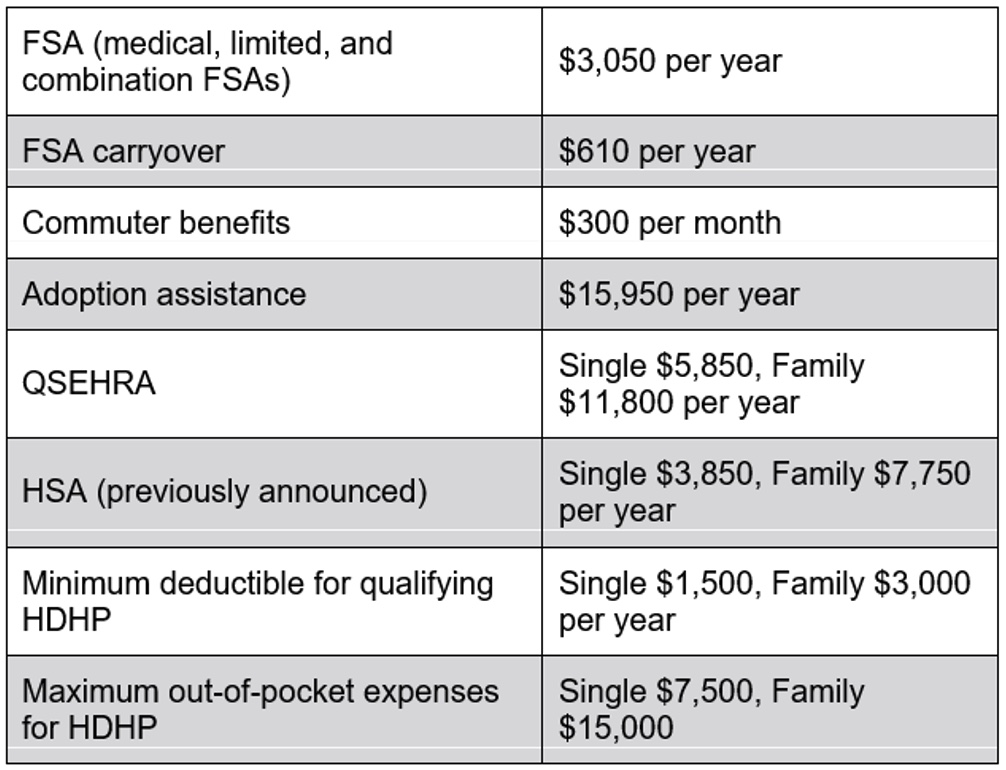

Fsas only have one limit for individual and family health plan participation,. This estimator accounts for annual limits on fsas, which are $3,050 for medical expenses per plan year, and $5,000 for dependent care expenses per plan year.

Dependent Care Fsa Contribution Limit 2025 Calculator Lotty Riannon, For example, here’s how you set $2,700 as the limit for dependent care fsa for the year 2025:

Dependent Care Fsa Contribution Limit 2025 Calculator Lotty Riannon, Estimate how much you can save with an fsa.

Dependent Care Fsa Contribution Limits 2025 Over 50 Ilene Lavinie, The 2025 maximum fsa contribution limit is $3,200.

Fsa Dependent Care Limit 2025 Calculator Darb Minnie, An fsa contribution limit is the maximum amount you can set aside annually from your paycheck to fund your fsa.

Fsa Rollover Amount 2025 Calculator Debee Ethelyn, 1, 2025, the contribution limit for health fsas will increase another $150 to $3,200.

Annual Dependent Care Fsa Limit 2025 Eirena Malory, You can use an fsa to save on average 30 percent 1 on healthcare costs.

Annual Dependent Care Fsa Limit 2025 Married Ray Leisha, Using an fsa calculator, you can examine the tax benefits of contributing to an fsa.

2025 Fsa Contribution Limits Jess Romola, But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

IRS Announces 2025 Increases to FSA Contribution Limits SEHP News, Deductible — how much you’ll have to spend out of pocket for covered services.

Fsa Limits 2025 Family Auria Sharlene, Like the 401(k) limit increase, this one is lower than the previous year’s increase.